While perhaps more commonplace in many parts of the world than others, emissions trading systems are becoming a global trend to motivate heavy industry on the road to decarbonization. Yet, emissions trading systems are as diverse and complex as the industries they impact. The difference and relationships between terms like emissions trading system (ETS), carbon taxes, and carbon credits can be just as complicated but are crucial to grasp the impact of these systems. Here, we take an opportunity to unpack these terms, uncover what they mean for the metals industry, and begin to understand the cost of carbon.

More than simply a buzzword, decarbonization is a serious topic, both for the steel industry and climate change. Decarbonization is key to curbing the effects and impacts of climate change and redefining heavy industry to be more environmentally friendly. Unfortunately, the technologies available today demand a high amount of capital investment to be implemented. Large capital investments are one of the significant hurdles regarding the widespread adoption of environmentally friendlier technologies. Therefore, to accelerate this transition, governments look toward implementing systems that add a cost element to the emissions from heavy industries that make the investment in decarbonization technologies more appealing and distribute pressure more evenly across sectors allowing for gradual transformation.

Trading versus Taxation

Before delving into the details regarding emissions trading systems, one valuable distinction is the difference between an emissions trading system and a carbon tax. Plainly stated, carbon taxes are a direct tax on fossil fuel emissions. However, carbon taxes themselves can often vary from country to country, and in many cases, governments will opt for a carbon tax or an ETS. Carbon taxes are unique in a few areas essential to understanding the difference to an ETS.

One clear distinction is that carbon taxes are applied to all emissions but can vary within a country and even apply to different sectors. For example, since 2019, Canada has set a price on carbon pollution. The latest legislation has also adapted their pricing to increase from 2023 to 2030 based on the latest information regarding climate change. Their tax system provides an ideal backdrop for understanding the difference between putting a price on fuel and overall carbon output from industries. For Canadians, the carbon price is a fuel tax, including gasoline, diesel, natural gas, and other hydrocarbon fuels. These taxes are placed directly on the fuel, impacting heavy industry and consumers. The out-put-based pricing system applies a carbon tax to large industrial emitters for their overall emissions but does not apply to emissions from individual households or consumers.

Across the globe, Germany implemented a price on CO2 for vehicles and buildings in 2021. With the new additions in Germany, individual households and vehicle owners will also experience a regulated price on CO2 emissions. In terms of costs and offsets, consumers will be able to receive credit and support if the price incurs unwanted financial difficulties. However, additional charges are intended to encourage “greener” investments and a shift toward environmentally friendlier practices. The fixed price on carbon in Germany operates similarly to a tax, and the price will remain fixed until 2026. After that, carbon pricing will be negotiated on the open market. Thus, the system gradually transitions from something akin to a carbon tax to a cap-and-trade system for emissions.

Cap, Trade, Reduce

Turning the page from carbon taxes to emissions trading systems (ETS), applying a cap-and-trade system brings the logic of the open market to carbon emissions. Focusing on the first and largest ETS system, the E.U. ETS sets a cap on the number of greenhouse gas emissions companies can emit each year. Each company purchases carbon certificates that meet its needs in terms of emissions. If they exceed this amount, they face fines. Still, if they need more, they can either reduce their emissions by investing in environmentally friendly technologies or purchasing excess certificates from another company.

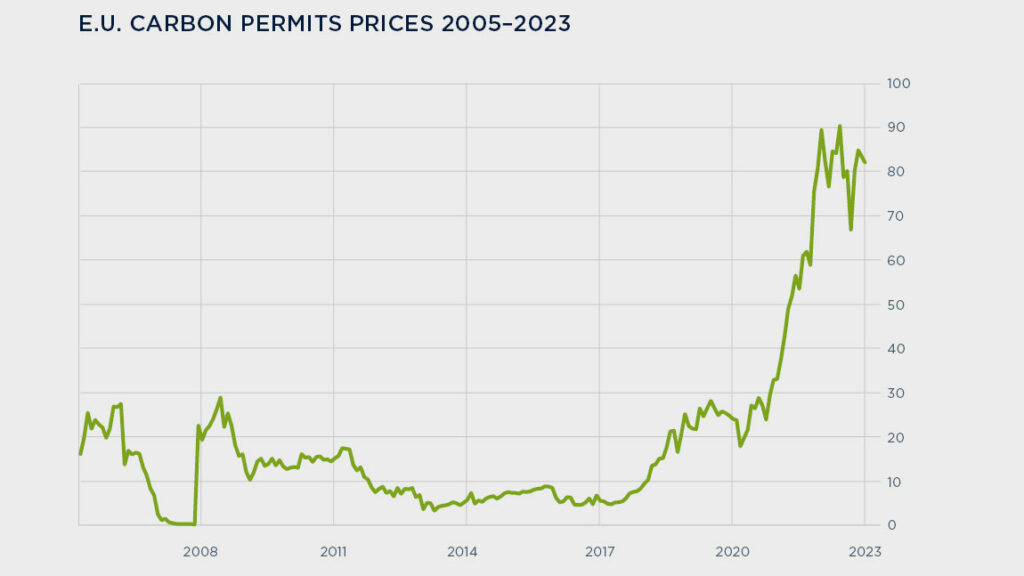

For industry, the financial incentive to reduce emissions is directly impacted by the price set on carbon certificates. With an ever more limited amount of carbon certificates available, the cost of investing in emissions-reducing technologies will become more and more appealing. After their revision in 2021, emissions cuts will also increase by 2.2 percent every year. Additionally, the number of allowances that industries can hold from year to year will only reflect the auction volume of the previous year after 2023, lessening the ability of an emitter to stockpile allowances. Beyond that, several funds have been established to aid the industry transition, particularly for energy-intensive industrial and power sectors.

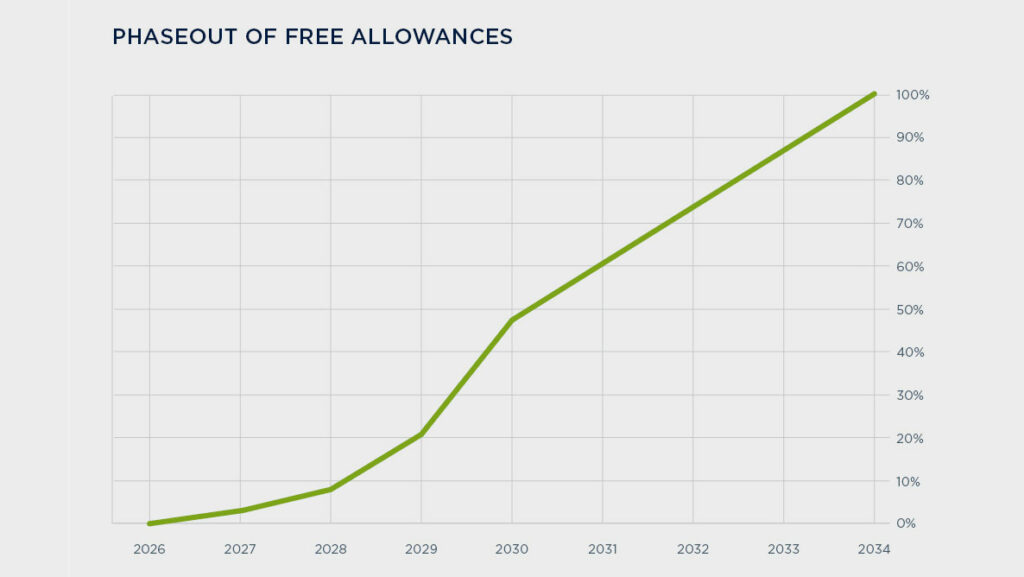

the ETS accelerates until 2030 before proceeding linearly toward 2034/35.

ETS and the Metals Industry

As a hard-to-abate industry, emissions trading systems and carbon taxes will have specific implications for the metals industry, primarily due to carbon-intensive processes like the blast furnace-basic oxygen furnace steelmaking process. What is clear is that steel producers in countries with strict carbon emissions pricing schemes, whether carbon taxes or emissions trading systems, should begin looking at decarbonization technologies early to avoid incurring costs in the future.

For example, the E.U.’s Carbon Border Adjustment Mechanism (CBAM) has begun to come into play to manage emissions and mitigate the phenomenon known as “carbon leakage.” Carbon leakage occurs when industries move the carbon-intensive portion of their business to countries or regions with weaker legislation regarding carbon emissions. The carbon thus “leaks” through the cracks in the system. Currently, producers in the E.U. only need to report direct and indirect emissions from 2023 until 2025. However, from 2026 on, the free allocation period for steel producers will be phased out, and the actual cost of carbon will play a significant role.

Funding a Sustainable Future

While the E.U. ETS and carbon taxes worldwide aim to motivate heavy industry to transform, the funding of these projects ties emissions trading systems and carbon taxes to actionable changes. In the E.U., the ETS provides revenue for the “Innovation Fund,” estimated to amount to around 38 billion euros from 2020-2023, estimating a cost of 75 euros per ton of CO2. The Innovation Fund may then be used for innovative and flagship projects to reduce capital investment risk and further drive climate innovation.

Regardless of each producers approach, what’s clear is that the future of heavy industry requires sustainable technologies and a commitment from CO2 emitters to lessen their environmental impact. With carbon-neutral targets being set for the coming decades, carbon-intensive industries, such as the metals industry, will have to factor in the cost of carbon to their bottom line. Additionally, as more countries roll out various ETS and carbon pricing schemes, early investment in optimization and decarbonization technologies anticipates future costs and ensures sustainability and resilience against the cost of carbon.

ETS implemented or scheduled for implementation

Carbon tax implemented or scheduled for implementation

ETS or carbon tax under consideration

ETS and carbon tax implemented or scheduled

ETS implemented or scheduled and carbon tax under consideration

Carbon tax implemented or scheduled and ETS under consideration

The map above (source: World Bank) visualizes ETSs worldwide, including implemented systems, upcoming implementations, and countries considering implementation of an ETS. With environmental pressures on the rise, the relevance of these types of systems and taxes will increase as the cost of carbon becomes a deciding factor for the sustainability of heavy industries.