This post is also available in: 简体中文 (Chinese (Simplified))

[This article was originally published in Metals Magazine #09 (Jan 2020) and updated in September 2021 to reflect new developments.]

Iron and steel production is responsible for 7 to 10 percent of global CO2 emissions. A decisive shift away from carbon-based reductants to alternatives like hydrogen is all but inevitable—but it will have to come in stages.

The steel industry’s biggest product today isn’t steel—it’s carbon.

Roughly 1.8 tons of CO2 are released into the atmosphere for every ton of liquid steel produced on the still predominant, integrated route. And this number is based on calculations that assume an average, modern blast furnace operated in OECD Europe—many plants around the world emit three or more tons of CO2 per ton of steel. These facts are hardly news to decision makers inside the industry. But they are only beginning to dawn on governments around the world who are now weighing their options for bringing about the massive reductions in greenhouse-gas emissions mandated by the Paris Climate Agreement. As some of these governments strive toward the even more ambitious goal of net-zero carbon emissions by 2050, scrutiny is inevitably going to increase and pressure is going to build on steel producers to bring down emissions in drastic ways. Emissions-trading schemes are going to be implemented and widened in scope, carbon taxes are looming, and consumers will ultimately show concern for the carbon footprint of steel products.

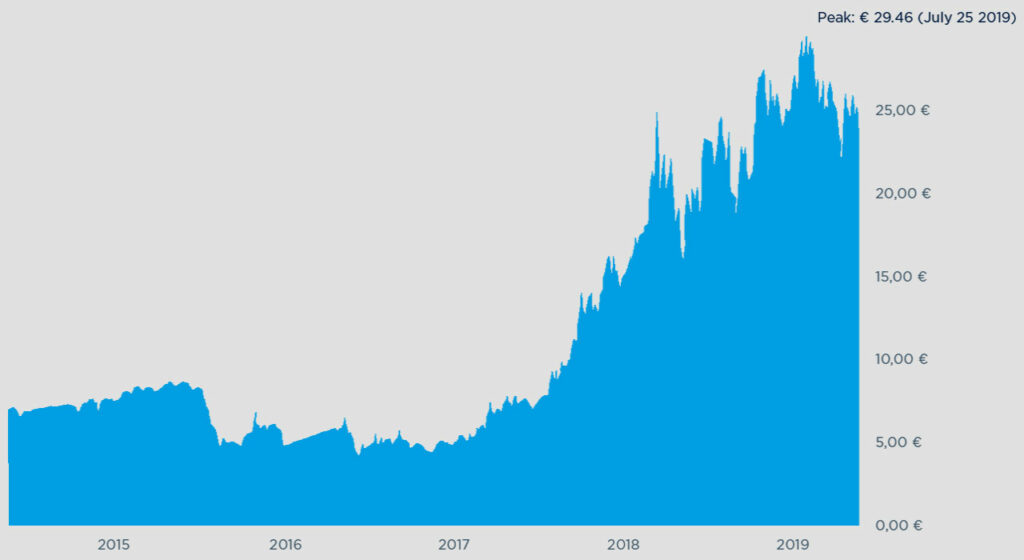

Producers in some parts of the world are already feeling the painful pinch of carbon pricing. The development of prices for European CO2 Emissions Allowances, as illustrated in Fig. 1, is a prime example. At their peak in September 2021, prices had seen an almost tenfold increase over a four-year period. And as of fall 2021 they appear to be climbing to record highs as the EU emissions trading scheme is enters its next phase—with several measures kicking in that will progressively tighten the supply of allowances.

In anticipation of such regulatory measures and market pressures, steel producers around the world are racing to deploy new technologies aimed at reducing carbon intensity in iron and steelmaking. Merely shifting production from coal and coke-based blast furnaces to direct reduction based on natural gas will not be sufficient. The industry will need to develop other energy sources without a direct carbon footprint, such as hydrogen, to commercial scale and in a manner that is economically feasi

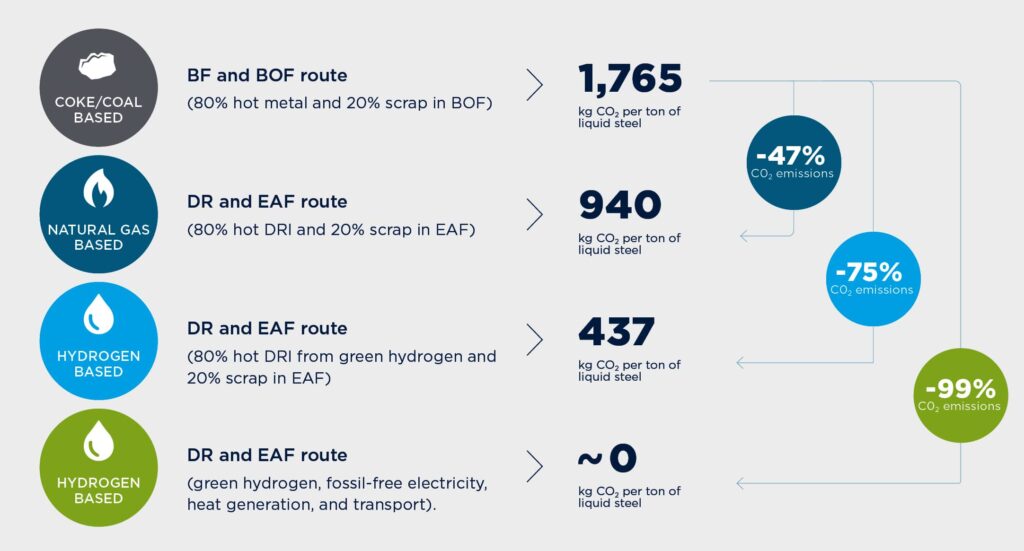

Comparing the Production routes

As Fig. 2 shows, the DR-EAF route, applying natural gas in the process, cuts carbon intensity for liquid steel by almost 50 percent in comparison with the conventional blast furnace to basic oxygen furnace route. By using green hydrogen instead, emissions can be reduced by 75 percent. Most emissions at this point are actually attributable to electricity production for the EAF process. The calculations are based on a grid emissions factor of 0.452 kg of CO2 per kWh—the average value for OECD Europe. Applying the emissions factor of Sweden (currently at 0.023 kg of CO2 per kWh) would bring emissions down to only 181 kg CO2 per ton—a whopping 90 percent reduction compared to the BF–BOF route. From there, all that stands in the way of true zero-carbon iron would be the provision of fossil-free energy for electricity, heat, and transport.

Producing hydrogen at scale

Needless to say, establishing a ready supply of hydrogen that can make iron and steelmaking truly carbon-free will be a major challenge. One of the key barriers is the sheer volume needed to support a massive upscaling in use by the industry. The amount that will be consumed is tremendous. Converting a typical integrated plant with a production of 5 million tons per year from coal and coke to hydrogen will require a supply of at least 480,000 Nm³ (equaling 44 tons) of hydrogen per hour. To put this into perspective, the largest proton exchange membrane (PEM) electrolyzer currently in operation generates only about 3,800 Nm³ (i.e., 0.35 tons) of hydrogen per hour. A number of gigawatt-scale electrolysis projects are underway, but those will take years to come online.

Not only will vast quantities of additional hydrogen be needed to support the steel industry, but it will also have to be produced using alternative processes. Currently, around 95 percent of hydrogen is “gray”—meaning it is produced by extracting gas from fossil fuels. It is possible to use carbon capture, utilization, and storage (CCUS) technology to prevent emissions from being released into the atmosphere, resulting in “blue” hydrogen. But this only makes economic sense where a high volume of CO2 can be captured at a single site. And it is only feasible in areas where there are geologically safe places to store captured carbon, such as beneath the sea or deep underground.

A green-hydrogen revolution

To be a true game changer, the hydrogen used in the ironmaking process must be “green” hydrogen, generated by electrolysis from water, using fossil-free power only. To date, producing hydrogen in this way has proven too costly to be competitive. But this is changing, as the boom in renewable energy sources, like wind and solar, brings down global electricity prices and hydrogen production offers a way to store energy in times of excess electricity production — when the wind is blowing or the sun is shining during times of low demand. Establishing a policy and financial incentive framework for adopting hydrogen is an essential part of this shift toward a more sustainable future, which gives industry leaders the confidence to invest in long-term hydrogen projects.

For example, a project called the Western Green Energy Hub plans to generate green hydrogen with up to 50 gigawatts of renewable power from wind and solar in Western Australia, covering an area half the size of Belgium. Mirning Traditional Lands Aboriginal Corp., an entity representing the area’s indigenous landowners, is part of the project. The installation is to produce as much as 3.5 million tons of green hydrogen per year, starting in 2030. This would be enough to produce almost 60 million tons of green, direct-reduced iron per year — more than half of today’s global output of direct-reduced iron.

Using hydrogen to decarbonize ironmaking and other industrial processes is a powerful idea—but not actually a new one. Leaders in the industry who are now nearing retirement may remember it vividly from their student days. There were peaks of interest in the ’70s during the oil price shocks, the ’90s with incipient concerns about climate change, and in the early 2000s on the same note. None of these developments resulted in a breakthrough moment for hydrogen. However, this time around may well be different: As the International Energy Agency (IEA) notes in a recent report, last year marked a period of unprecedented momentum for hydrogen, combining a new depth of political enthusiasm with a breadth of new possibilities around the world.