As the European Union pushes forward with an ambitious roadmap

for a sustainable, “no net emissions” future, Claire Coustar, Head of ESG, FIC, Deutsche Bank explores how the steel industry can ensure it has the funding needed to support—and even drive—this green transition toward a zero-carbon future.

The world is stepping up its efforts on a momentous project—the fight to limit the damage from climate change. Pre-eminent among the battle objectives is the call to reduce CO2 emissions for energy-intensive industries in order to meet climate objectives. Nowhere is this more apparent than in the steel sector, which, according to the World Steel Association, accounts for up to 9 percent of all direct fossil-fuel emissions globally.

The European Union has traditionally been at the front line. As the bloc follows a path toward net zero emissions by 2050—the primary goal of the European Green Deal, whose latest proposals were announced in July—the process of “greening” the steel industry, in other words pivoting to the production of Green Steel, has gained more urgency. And other major steel producing economies are proceeding along similar lines: both Japan and Korea have announced net-zero targets and even China is now on a zero-carbon deadline. But with the industry still feeling the effects of faltering demand and disrupted supply chains, how can it achieve the significant funding needed to make this vision a reality? The emerging sustainable-finance market has a key role to play.

Decarbonizing the steel industry will cost more than 1.4 trillion dollars. The emerging sustainable-finance market has a key role to play in funding the transition.

Greening the industry

A concerted, global effort to decarbonize the economy is underway—one that aims to shift the energy mix away from fossil fuels in moving toward a renewable future. As part of this journey, several ambitious targets have been laid out by governments and corporations alike. The biggest of these is the Paris Agreement, a legally binding international treaty on climate change. Adopted by 196 parties, the agreement aims to limit global warming to well below 2 °C—preferably to 1.5 °C—compared to pre-industrial levels.

To ensure sustainability efforts stay on track, Europe has laid out a comprehensive roadmap to prepare the continent for a net-zero future. In December 2019, the European Commission announced the “European Green Deal”—the bloc’s most ambitious attempt to date to counter climate change and environmental degradation. In line with the Paris Agreement, the initiative targets zero net emissions of greenhouse gases by 2050 and is underpinned by a series of interconnected goals covering almost every element of the economy, including energy, construction, agriculture, and transport.

Meeting the aims of the Green Deal involves a massive funding injection for every part of the economy, in every industry and across every sector. At least 1 trillion euros in funding is needed for the coming decade and while a large share of this will come from the E.U. budget and national governments, a contribution worth 279 billion euros is required from the private sector. Looking only at the steel sector (but taking a global view) the I.E.A. has projected a cumulative need for investment of around 1.4 trillion dollars until 2050.

This presents a huge challenge for banks, and also a huge opportunity. Capital will need to be allocated, and banks—those best positioned to support sustainability—can be there to provide it. But how exactly will the funding be achieved?

Integrating ESG into finance

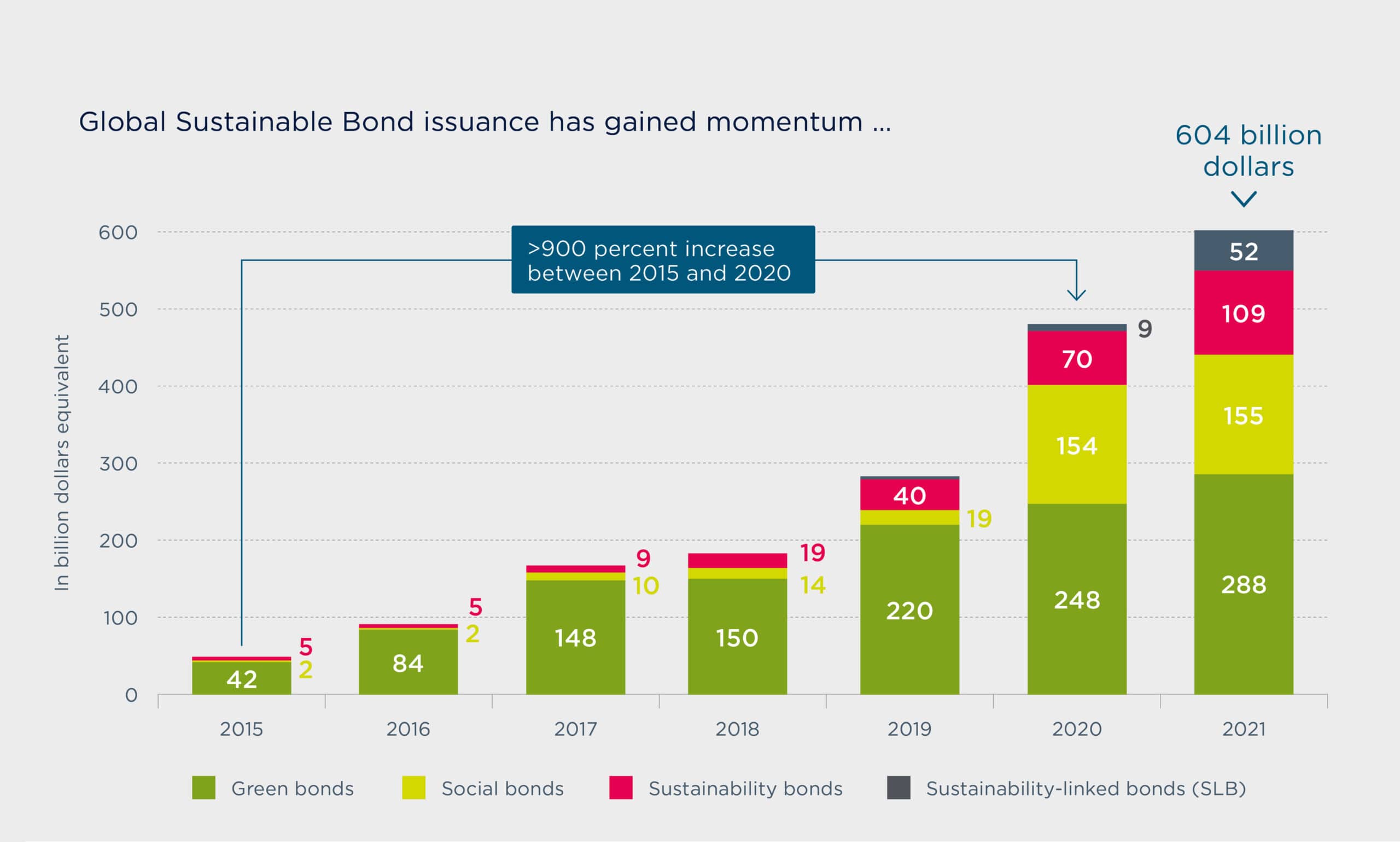

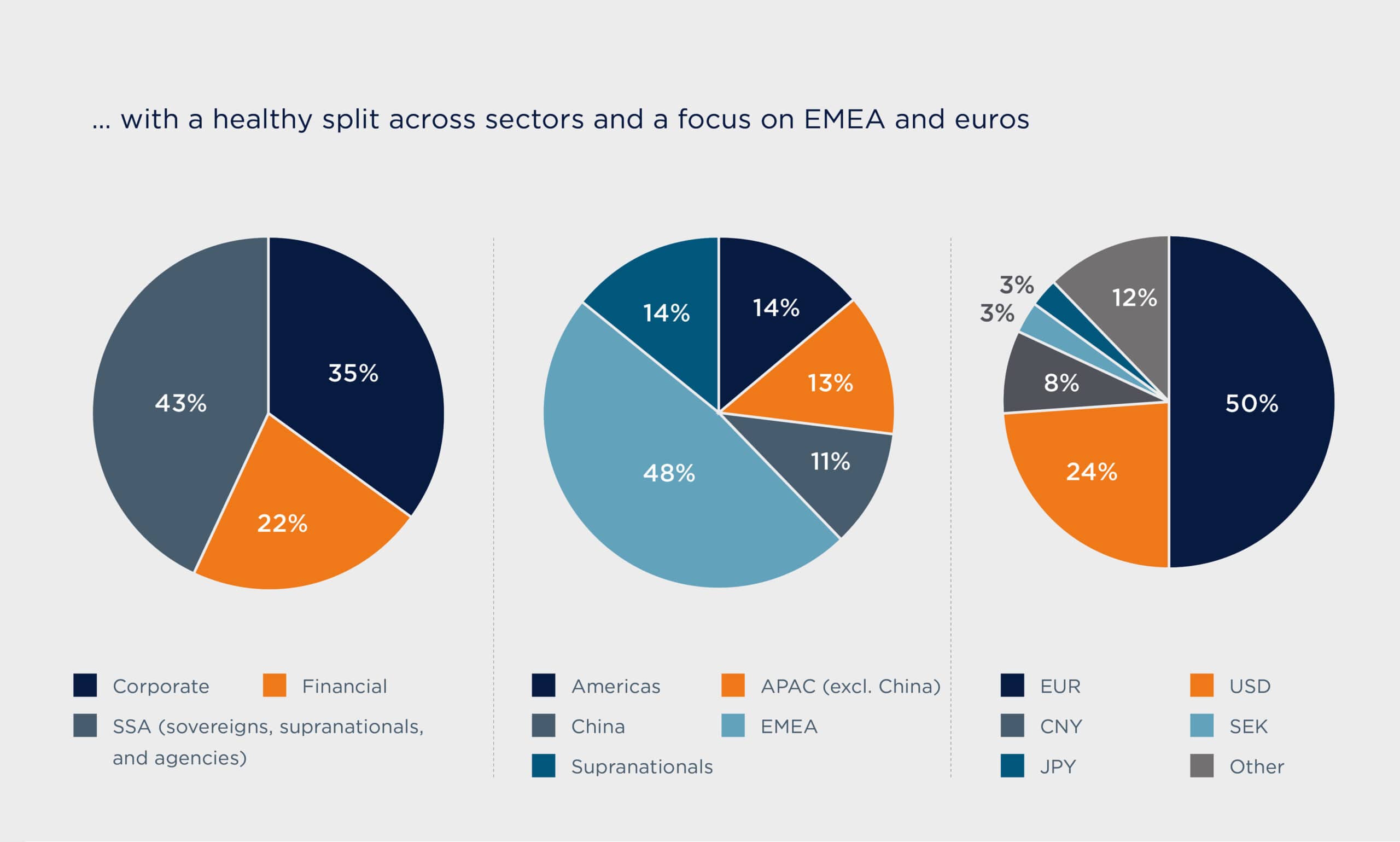

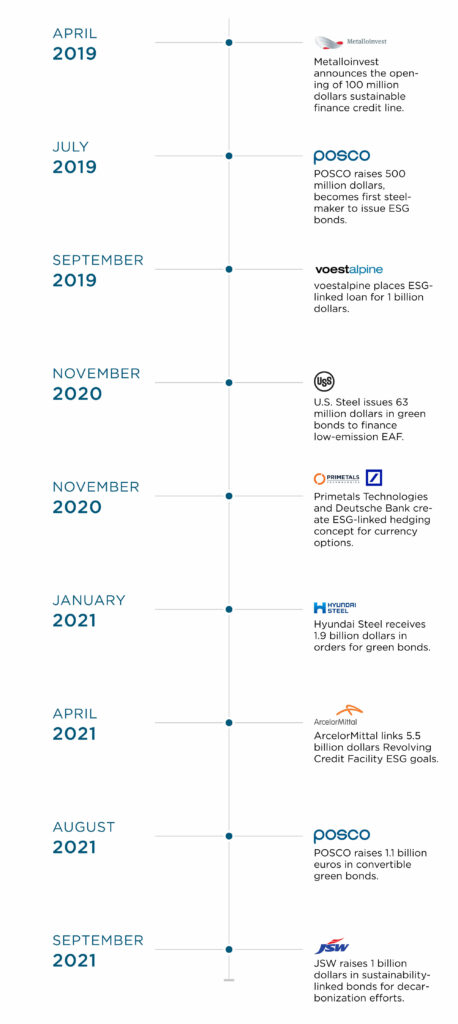

The shift toward sustainable financing—with tools linked to “ESG” criteria: environment, social, and governance—has already begun. It is best illustrated by the recent, exponential growth of the green-bond market. Ten years ago, it had yet to develop, yet fast-forward to today and total market capitalization recently surpassed 1 trillion dollars. In the past decade, the market for both green bonds and green financial instruments in general has expanded significantly. For example social bonds have seen a significant surge, especially since the onset of Covid-19, while the market for sustainability-linked instruments (which tie the cost of the financing to performance on ESG metrics) has also grown substantially.

In part, this growth is down to the increasing awareness among corporates of the urgent need to tackle climate change, but it is also being driven by governmental and regulatory policies. For instance, in June 2020 the European Union published its Taxonomy Regulation—a classification system for green investments that, it is hoped, will be instrumental in the E.U. scaling up sustainable investment and implementing the European Green Deal. Under the taxonomy, activities are considered to be “green” if they substantially support one (or more) of six objectives: climate change mitigation; climate change adaptation; sustainable use and protection of water and marine resources; circular economy; pollution prevention and control; and biodiversity. By providing a common language, issuers will be able to more easily demonstrate how their efforts align with the Paris Agreement and goals of the European Green Deal, while investors should more easily avoid the reputational risks of associating with activities that undermine environmental objectives.

Challenges for the steel industry

Among the largest contributors to carbon emissions is the steel industry. And even Europe, with all its modern assets and infrastructure, has much remedial work to do. Recent statistics from industry group Eurofer show only around 40 percent of the 160 million tons of crude steel produced in the EU comes from electric arc furnaces. The rest involves traditional blast furnaces—a good indication as to why carbon emissions run so high in this industry.

Indeed, after the power-generation sector, iron and steel is the largest industrial producer of CO2 emissions in Europe—with the industry currently generating 221 megatons of greenhouse-gas emissions annually, representing 5.7 percent of total E.U. emissions. Reducing CO2 levels for this energy-intensive industry will, therefore, be central to meeting the E.U.’s climate objectives.

Toward this goal, over the past year major mining and steel companies have put a significant focus on climate-change disclosure—with many corporates having now adopted the major voluntary reporting guidelines, including the Global Reporting Initiative and the Financial Stability Board’s Task Force on Climate-related Disclosures (TCFD).

At the same time, individual companies are stepping up to the fold. In September 2020, ArcelorMittal, the world’s largest steelmaker, became the first to pledge net-zero emissions by 2050, with plans to combine small amounts of hydrogen with coal in a blast furnace, as well as substituting wood biomass for coal in processes. Unfortunately, these efforts will prove costly. The company estimates that decarbonizing its facilities in Europe alone—in line with the E.U.’s Green Deal—will require between 15 billion and 40 billion euros and won’t be profitable before the 2030s. And the price is estimated to be just as eyewatering for others in the industry, with a July 2021 Deutsche Bank Research paper, titled “Can Mining & Steel sustain in a low carbon world?,” reporting that the capex bill for European carbon steel over the next 10 years could reach 20 billion dollars for the already capital-constrained sector.

European steel has been struggling in recent years, hit by the trio of stagnating demand, international-trade distortions, and the impact of Covid-19 on supply chains. At the same time, the industry is expected to turn its attention to a complete rethink of its existing processes to facilitate substantial reductions in emissions—something it has to do quickly and at great expense. As explained in the European Commission’s report “Towards Competitive and Clean European Steel,” these headwinds, combined with the cost and urgency of upgrades “makes for an exceptionally challenging business environment and illustrates many of the challenges that E.U. industry at large faces.” So how exactly can the struggling industry meet these capex demands? One potential route is through the sustainable-financing market.

Greening the industry

A concerted, global effort to decarbonize the economy is underway—one that aims to shift the energy mix away from fossil fuels in moving toward a renewable future. As part of this journey, several ambitious targets have been laid out by governments and corporations alike. The biggest of these is the Paris Agreement, a legally binding international treaty on climate change. Adopted by 196 parties, the agreement aims to limit global warming to well below 2 °C—preferably to 1.5 °C—compared to pre-industrial levels.

To ensure sustainability efforts stay on track, Europe has laid out a comprehensive roadmap to prepare the continent for a net-zero future. In December 2019, the European Commission announced the “European Green Deal”—the bloc’s most ambitious attempt to date to counter climate change and environmental degradation. In line with the Paris Agreement, the initiative targets zero net emissions of greenhouse gases by 2050 and is underpinned by a series of interconnected goals covering almost every element of the economy, including energy, construction, agriculture, and transport.

Claire Coustar is Managing Director, Global Head of ESG for Fixed Income & Currencies at Deutsche Bank. Claire joined in 2003, and during her tenure she has held various positions across structuring, sales, trading, and governance; including Head of Emerging Market Structuring and Co-Head of the CEEMEA Structured Credit Trading. Prior to Deutsche Bank, Claire held various positions in the New York and London offices of Merrill Lynch, including Commodity Derivative, European Securitization, and Latin America Structured Products groups. Claire holds a Bachelor of Science degree from Babson College with major in Finance, Economics, and International Business and a Non-Executive Director Diploma from the Financial Times. Claire represents Deutsche Bank in the Net Zero Banking Alliance, is a member of the Group Sustainability Council, and represents the Investment Bank on Deutsche Bank’s Green Bond Forum. Claire sits on the Fixed Income and Currencies Executive Committee of Deutsche Bank and is Vice-Chair of the Board of Directors of Deutsche Bank Turkey.