This post is also available in: 简体中文 (Chinese (Simplified))

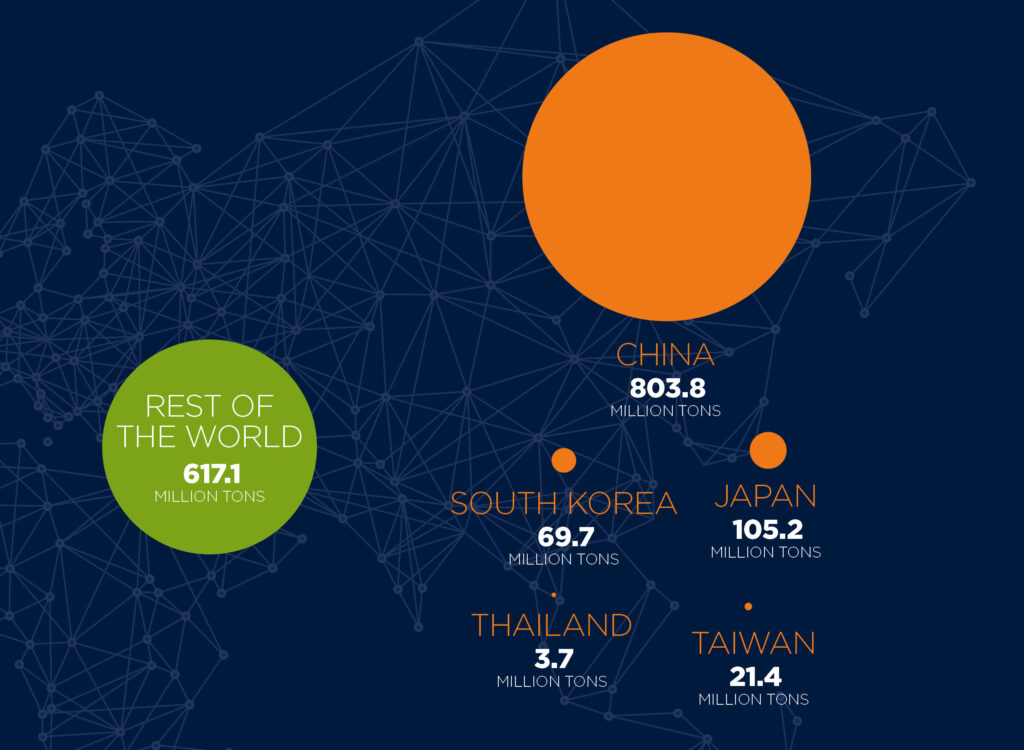

East Asia is a of great relevance when it comes to the world’s overall steel production capacity. In 2015, China alone manufactured nearly as much steel as the rest of the world combined. But also Japan, South Korea and Taiwan are playing important roles in their region. Consulting Editor Dr. Tim Smith takes a closer look at the East Asian steel industry.

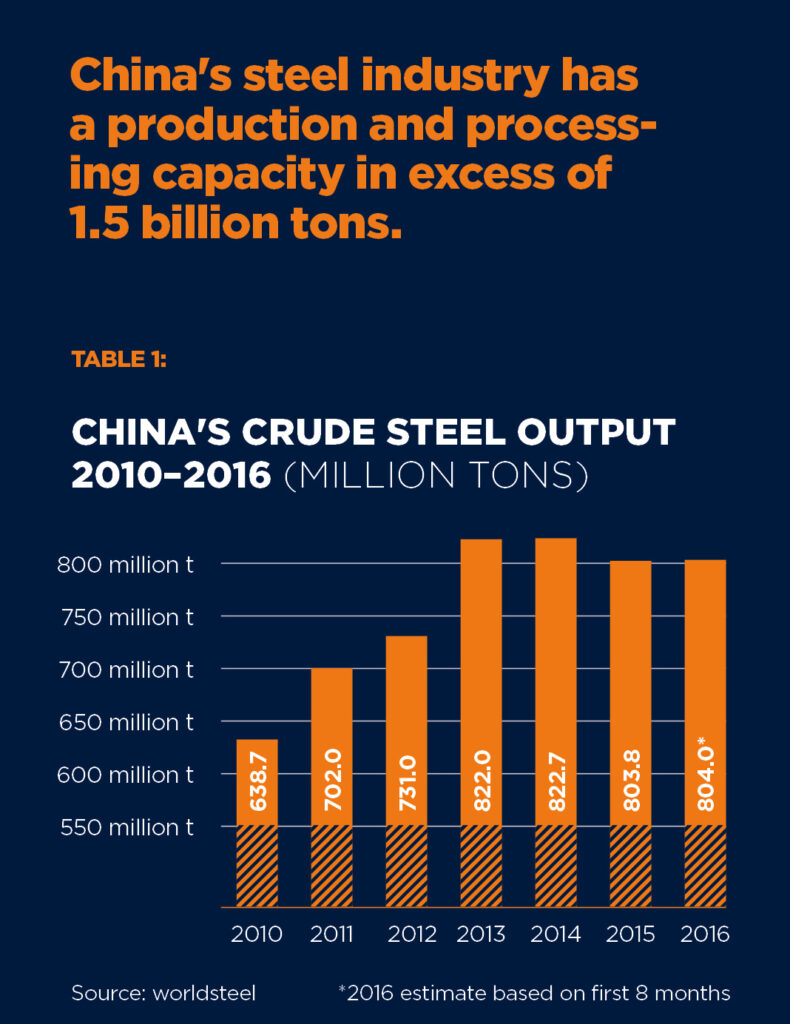

Steel production in East Asia – and indeed the world – is dominated by the output from China, which in 2015 produced 803.8 million tons of crude steel that accounted for 49.6% of total world production. Nevertheless, there is a slowing trend in Chinese output, as the country produced 822.7 million tons in 2014 and is projected to make around 804 million tons in 2016 – based on the first eight months of the year.

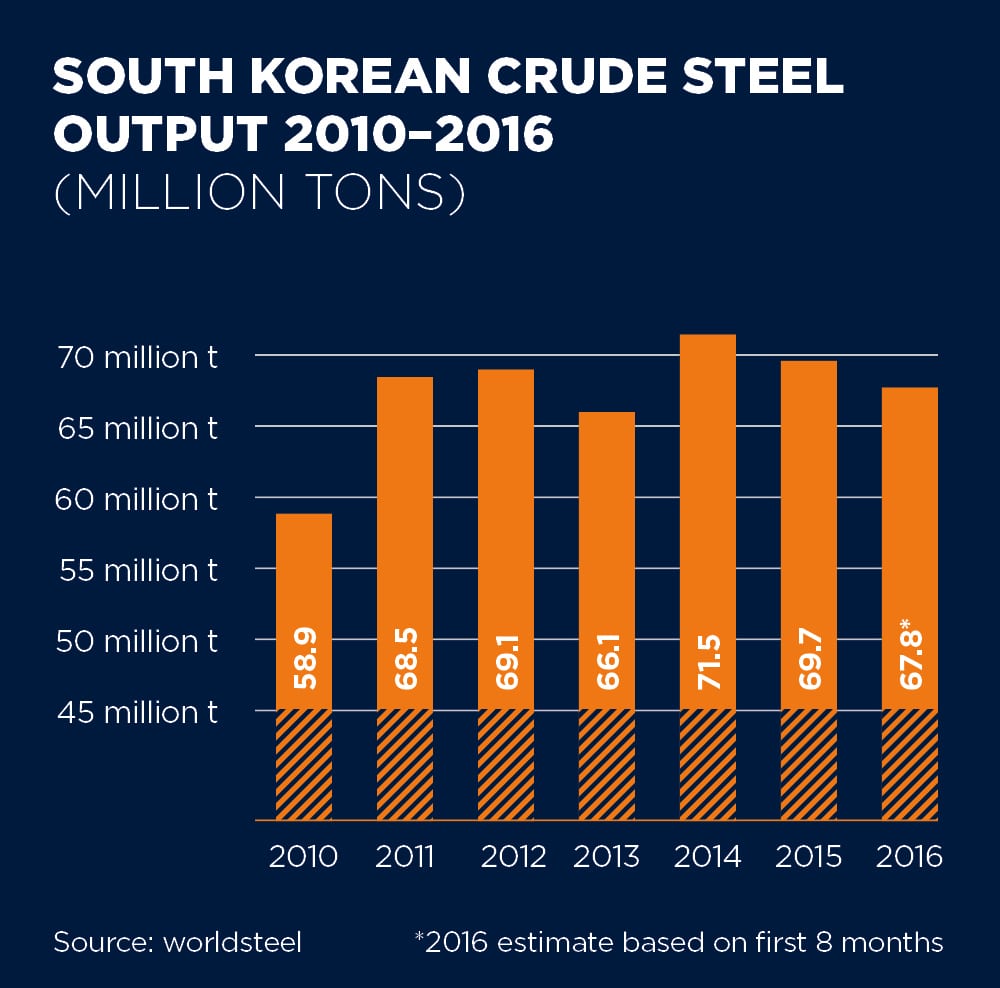

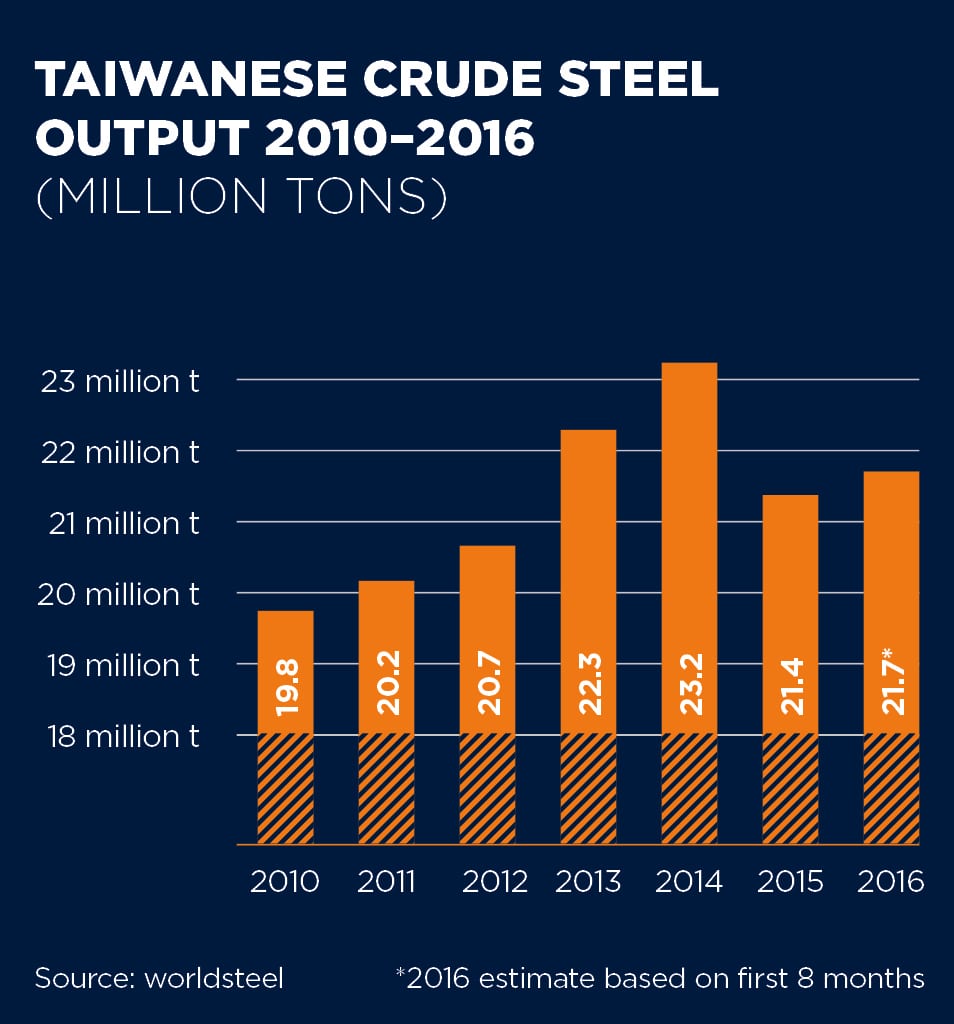

This declining trend is reflected throughout all the major producers in East Asia, and, indeed, across the world. This is in response to addressing the issue of overcapacity, which has resulted in a glut of steel on world markets and a corresponding decline in prices. Japan is the second-largest producer in the region, making 105.1 million tons of crude steel in 2015, down 5% on 2014, followed by South Korea at 69.7 million tons (-2.6%) and Taiwan at 21.4 million tons (-8%). There is little data available for North Korea, which is estimated to have produced 1.25 million tons in 2014 and no data for Mongolia. Neighboring producers in Southeast Asia – referring to worldsteel statistics for 2015 – are Vietnam (6.1 million tons), Indonesia (4.2 million tons), Malaysia (4.1 million tons), Thailand (3.7 million tons), Philippines (1.1 million tons), Singapore (0.54 million tons) and Myanmer (estimated 35,000 tons).

China: Capacity Cuts and Mergers

China’s economy grew by 6.9% in 2015, the slowest in 25 years, as global demand ebbed. Following billions of dollars in government spending and a property boom in the country’s top-tier cities, official data in recent months is starting to point to some stabilization in the economy. However, GDP in Q1 2016 fell further, and forecasts for Q3 project a growth of 6.7 to 6.8%.

China has become the world’s second-largest economy. However, the export-driven and investment-led growth model that once propelled development has reached its limits. Emerging problems such as industrial overcapacity, high debt levels, pollution and sluggish global demand all weigh on growth. Instead of making any radical stimulus moves, China has resorted to supply-side structural reform to optimize its economic structure, cut industrial overcapacity, slash costs and boost efficiency.

The economy is now more balanced and driven more by consumption than investment. Consumption contributed to over 73% of China’s economic growth in the first half of 2016, up 13.2% year-on-year. Torpid state-owned firms are undergoing modernization; steel, coal, power generation and other heavy industries are slashing capacity, and the government is ceding more power to the market.

China’s desire to upgrade its manufacturing sector means lucrative business opportunities for multinationals. Foreign investment in high-tech services in China from January to June 2016 nearly doubled over the previous year. Chinese enterprises invested $88.9 billion in 155 countries and regions from January to June 2016, surging 58.7% year-on-year. They created local jobs and helped upgrade local industries.

Steel restructuring

China’s steel output is strongly biased toward the integrated blast furnace–converter route. Of the 803.8 million tons produced in 2015, 93.9% was produced in the oxygen converter and just 6.1% in electric arc furnaces. Of total production, 98.3% was continuously cast. China’s steel industry has a production and processing capacity in excess of 1.5 billion tons.

Plans are underway to reduce this by 10% by 2020. In the past five years, capacity has been cut by over 90 million tons. In 2015, China closed 31 million tons’ worth of iron and steelmaking plants, and intends cuts of 43 million tons during 2016. Reducing overcapacity is high on the central government’s reform agenda, as excess capacity in steel and coal weighs on the country’s economic performance. Ironically, the cuts in coal capacity (101 million tons in 2015) have resulted in fairly significant pressure on the supply of coking coal, which has seen the price demanded by suppliers rise to $200/t compared with $92.5/t in Q3.

The Ministry of Environmental Protection has set up inspection teams to determine whether the country’s steel sector is meeting state technology and emission standards. After visiting 1,019 steel companies, the inspectors found that 173 had broken the rules, with 62 involved in illegal construction.

Mergers

In addition to capacity cuts, mergers between major steelmakers are happening. The merger of China’s two major producers, Shanghai-based Baosteel Group and Wuhan Iron and Steel Group in Hubei Province, was approved by the State Council in September of 2016. In 2015, crude steel output at Baosteel was 34.94 million tons, with Wuhan having produced 25.8 million tons. This gave the newly merged company a total output in excess of that of China’s HeSteel Group, to rank first in the country and making it the world’s second-largest steelmaker, after ArcelorMittal.

Baosteel has vowed to cut steel production by 9.2 million tons between 2016 and 2018, and make product upgrading the priority in the restructuring drive. Next on the agenda is the restructuring of Ansteel and Benxi Steel Group, both based in the northeastern province of Liaoning. Ansteel Group Corp is China’s fourth-largest steelmaker by output, making 35.2 million tons in 2015, while Benxi made 15.0 million tons. Although the merger stalled in early 2016, it was expected to be completed by the time this article would be published.

Mergers of steel mills are not uncommon in China. Hebei Iron and Steel Group was formed by the merger of Tangsteel and Hansteel in 2008, while Ansteel is the result of the combination of Anshan Iron and Steel Group and Panzhihua Iron & Steel Group in 2010. The State Council has stated that by 2025, 60% to 70% of China’s steel output is to be produced by about ten large steel groups, including three to four groups with an annual capacity of 80 million tons, six to eight with an annual capacity of 40 million tons, and some specialty-steel groups.

Profitable steel

China’s steel industry improved its profitability in the first seven months of 2016 due to rising steel prices. Despite sales revenues of 373 steel companies falling 11.91% to 1.5 trillion yuan ($225 billion) during the period, their profits hit 16.3 billion yuan ($2.39 billion). However, market demand remains tepid, with steel consumption falling 3.6% year-on-year in July.

North China’s Hebei Province, home to a quarter of China’s steel manufacturing, reported strong profit growth in the first half 2016 after a drastic price drop in 2015. Steelmakers in the province made 15 billion yuan ($2.2 billion) in profits in the first six months, up 181% year-on-year. The profit margin stood at 3.02%. 63 of 78 steelmakers surveyed in the province were profitable during this period, an increase of 15% year-on-year.

In the latter part of 2015, the price of a ton of steel was cheaper than that of a ton of purified water, due to serious overcapacity and sluggish demand amid a slowing economy.

Baosteel Zhanjiang Iron & Steel Co. Ltd.

The continuous galvanizing line (CGL) processed the first coil at the end of March 2016.

Baoshan Iron & Steel Co. Ltd. (Baosteel)

Modernization of a 20-year-old DC twin electric arc furnace at its Shanghai plant

Shandong Iron & Steel Group Rizhao Co., Ltd.

Order of two twin-strand continuous slab casters

Shandong Iron & Steel Corporation Ltd (Shansteel)

Order of a Selective Waste Gas Recirculation (SWGR) system from Primetals Technologies for its new sinter plant in Rizhao, Shandong Province

Shandong Laigang Yongfeng Steel Corp. (Yongfeng Steel)

Contract for the supply of ERT-EBROS endless rolling technology for the company’s existing bar rolling mill in Qihe, Shandong province

Yongxing Special Stainless Steel Co., Ltd.

Supply of a new combination mill for the rolling stainless bars, bar-in-coil and wire rod

Tangshan Iron and Steel Group Co. Ltd. (Tangshan Steel)

Supply of two continuous galvanizing lines

Zenith Steel (Changzhou Zhongtian Iron & Steel)

Revamp of wire-rod mill

Baosteel Zhanjiang Iron & Steel Co. Ltd. (Baosteel Zhanjiang)

Order for a new Mulpic (Multi-Purpose Interrupted Cooling) system for a plate mill

Japan: High Yen Hits Exports

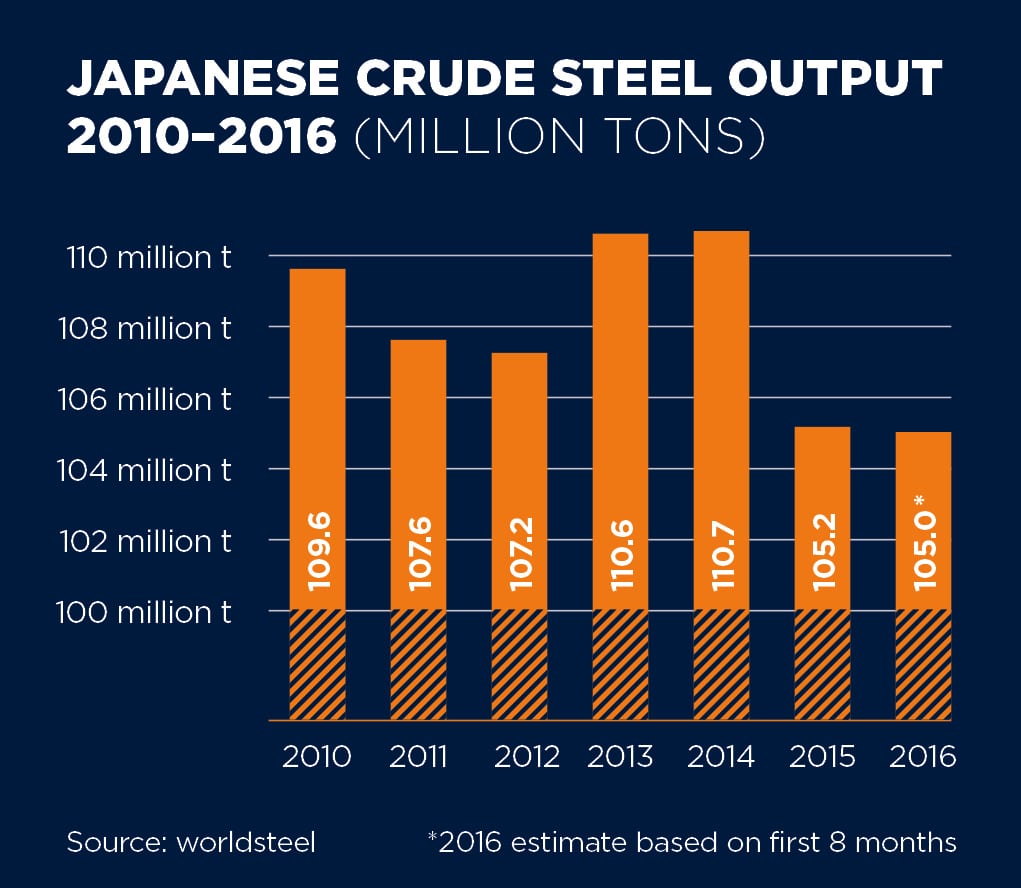

Crude steel production in Japan reached 105.2 million tons in 2015, and is set to reduce to around 105 million tons in 2016, based on the first eight months of the year. In recent years, output has been falling since 2014, following a peak in production of 120.2 million tons in 2007. In 2015, 77.1% of output was by the integrated blast furnace–converter route and 22.9% by electric arc furnaces. Continuous casting accounted for 98.1% of production.

Japan is the second-largest producer of steel in the world, after China, and the world’s third-largest economy. The merged company Nippon Steel & Sumitomo Metal Corp. ranked the third-largest steelmaker in 2015, producing 46.37 million tons.

Japan’s steel demand declined by 10 million tons in 2015 year-on-year or 15%. Production dropped by 5 million tons while imported steel also contracted by nearly 700,000 tons. Exports increased by 14% year-on-year or around 500,000 tons to 40.4 million tons. The first quarter 2016 saw a decline in profits for Japan’s industrial sector, reflected in an 18% fall in the Tokyo Stock Exchange.

JFE Steel Corporation

Primetals Technologies was entrusted with an order for a combination mill.

JX Nippon Mining & Metals Group

An order for a UCM-Mill for copper foil was received by Primetals Technologies from JX Nippon Mining & Metals Group.

Appreciation of the yen by 11% against the U.S. dollar in April through June 2016 became an increasing negative factor for exporting industries that saw exports of steel fall to 18.6 million tons in the first five months of the year. This was a decline of 3.3% over the same period 2015, while steel imports reached 12.7 million tons, meaning an increase of 4%. All the major steel companies reported losses in Q1 (April through June) 2016. Nippon Steel & Sumitomo Metals Corp. saw a current account loss of 12 billion yen ($111 million), and JFE Steel a loss of 13.3 billion yen ($123 million).

However, steel companies are expecting an improvement overall for fiscal year 2016, as steel prices have started to rise both in the domestic and export markets. By June, the spot market for hot-rolled coil in East Asia had improved 20% to $360/t from its 12-year low experienced at the close of 2015.

However, exports in July suffered their sharpest monthly fall in seven years, dropping 14%, as the yen continued to appreciate. Shipments of steel, cars and ships all fell, but imports dropped 25%, leaving a trading surplus for the month of 513 billion yen ($1.5 billion), the largest since 2009. In August, exports rose 2.3% to 3.5 million tons, but crude steel output fell marginally (0.65%) to 8.9 million tons from the July figure.

SOUTH KOREA: An improving position

In 2015, South Korea produced 69.7 million tons of crude steel, a fall of 2.6% from 2014, but an increase on years prior to that. 2016 is likely to see the decline continue with an estimated output of 67.8 million tons based on eight months of production. In 2015, 69.6% of output was via the integrated route and 30.4% by electric arc furnaces. 98.6% of steel was continuously cast.

South Korea had the highest apparent steel use per capita in 2015, followed by Taiwan at second, Japan at fourth, and China at fifth.

South Korea is the third-largest steel producer in East Asia. Its oldest established integrated company, POSCO, ranked fourth in world production in 2015 with an output of 41.97 million tons. POSCO’s largest integrated competitor, Hyundai Steel, produced 20.48 million tons.

POSCO is expected to make an operating profit of $800 million in the third quarter 2016, thanks to a recovery in global steel prices resulting from downscaling by Chinese rivals, and the company’s own cost saving measures. This is up 33% for the same period 2015 and up 28% from the previous quarter. It is the highest quarterly profit in two years. Profit for 2016 may exceed 3 trillion won ($2.67 billion), nearly double that of 2015.

The company’s affiliates at home and abroad have also improved, but POSCO’s patience seems to have run out regarding its plan to build a 12 million t/a integrated plant in Odisha, India, using the Finex process, which it first launched in 2007. The company decided not to renew its environmental permits after almost ten years in the planning.

While Hyundai Steel Co. is expected to post a significant jump in operating profits for Q2 2016, up 51%, the company has over 5 trillion won ($4.45 billion) in current liabilities. However, its bonds are graded AA, as it is backed by Hyundai Motor Company and Kia Motors.

Dongkuk Steel (an electric-arc steelmaker, and plate and long products roller) has close to 3 trillion won ($2.67 billion) in current liabilities and assets of 1.6 trillion won ($1.42 billion). Dongkuk bonds are graded BB.

Hyundai Steel

A continuous bloom caster, a large bar rolling mill and a small bar and wire rod mill started up at the new special steel mill in Dangjin.

Finex: A Joint Development Effort

Finex, a proven alternative ironmaking technology to the blast furnace, was jointly developed by Posco and Primetals Technologies. Molten iron is produced from ore fines and non-coking coal at reduced costs and lower environmental impact than the blast furnace.

TAIWAN: Returning Growth

Taiwan produced 21.37 million tons of crude steel in 2015, an 8% fall from the 2014 figure, but is on target to grow output to 21.7 million tons in 2016. 62.4% of output in 2015 was via the integrated route and 37.6% by electric furnaces. 99.6% of output was continuously cast.

China Steel Corporation, Taiwan’s largest and first integrated producer, made 14.82 million tons in 2015.

Taiwan faced a slowdown in steel demand in 2015, declining 2.6% year-on-year to 18.3 million tons. Domestic production decreased 8%, exports fell 5% to 10.4 million tons, and imports dropped 13.5% to 3.7 million tons compared to 2014.

Primetals Technologies is the only global provider of the complete spectrum of technological solutions and automation systems for ironmaking plants. Its portfolio of ironmaking equipment, which features the know-how acquired from decades of experience, includes:

- Hybrid Flotation Technology – An innovative technology for processing low-grade ores

- Circular Pelletizing Technology – The world’s most compact pelletizing solution

- Sinter plant – High performance and environmentally friendly sinter production

- Blast furnace – Process and cost optimization from a single source

- Corex – Cost-efficient and environmentally friendly cokeless ironmaking

- Finex – Highly cost-efficient ironmaking based on iron ore fines and non-coaking coal

- Midrex – the world’s leading DRI production process

In February 2010, Dragon Steel Co. became the second integrated producer in Taiwan with the start of No. 1 Blast Furnace at the Taichung Works. Designed and supplied by Primetals Technologies, the furnace is rated at 2.5 million t/a. After more than five years of consistent, trouble-free operation, more than 14 million tons of iron have been dispatched to the steel plant to date. Complemented by the similar-sized No. 2 Blast Furnace commissioned three years later, both ironmaking plants continue to exceed their rated production capacity.

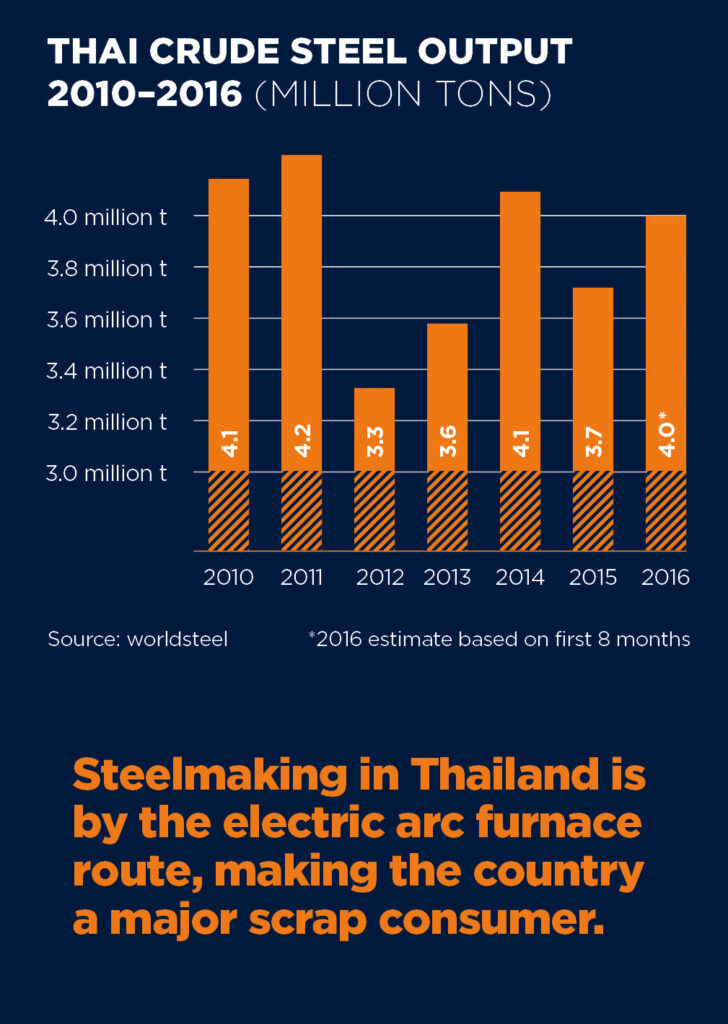

THAILAND: Recycling scrap

Thailand produced 3.718 million tons of steel in 2015, down 9.2% from 2014. It is on target to increase output to 4 million tons in 2016.

Steelmaking is by the electric arc furnace route, and the country is the second-largest scrap consumer in the region. Total scrap demand of 3.9 million tons represented a decline of 9.3% year-on-year in 2015. Domestic supply increased slightly, by 1.3% year-on-year to 3.4 million tons. Imports dropped substantially, by 31% year-on-year to 949,340 tons in 2015. Major import sources were U.S.A, Australia, Philippines, South Korea and Japan.

Scrap exports were quite significant at 397,457 tons, which was a moderate increase of 3.6% year-on-year in 2015. Thailand exported scrap to various countries, and major destinations were India, Indonesia, Japan, China, South Korea and Laos. Thailand is a manufacturing hub for other important steel consuming sectors such as the automotive and electrical appliance industries.

Revamp of NTS Arc Furnace

A 76 ton capacity electric arc furnace of N.T.S. Steel Group Public Company Ltd. is currently being modernized by Primetals Technologies at Chonburi. The furnace is being equipped with a new electrode control system, the Foaming Slag Manager and a Refining Combined Burner. The target of the furnace upgrade is to lower electricity consumption by 4% and electrode consumption by 17%. These improvements will contribute to a reduction of tapping times, increased furnace productivity and lower specific production costs.

Kobelco Millcon Bar Mill Upgrade

To increase the supply of special steel products, Kobelco Millcon Steel Co., Ltd. is modernizing a wire-rod mill in Rayong, Thailand with equipment supplied by Primetals Technologies. When completed in May 2017, the Thai mill will supply steel rods for automotive parts. Upgrades to the mill include a new mill-stand gear drives, water boxes, pinch rolls and laying heads, and the latest-design stepless reform. In addition,

Primetals Technologies will install a Morgan Reducing Sizing Mill with a quick-change feature to produce thermomechanically rolled products and improve tolerances, mechanical properties and coil packages. Speed guarantees for the 480,000 t/a mill will be 110 m/s, with a maximum rolling rate of up to 120 t/h.

REFLECTING ON CHINA

2016 saw China host the G20 meeting in September in Hargzhou city, the first time the country has hosted this prestigious event. Addressing the meeting, Chinese President Xi Jinping reassured the world’s business leaders that China can achieve strong growth, would not backslide on structural reform, and would open up to business activities.

China’s desire to upgrade its manufacturing sector means lucrative business opportunities for multinationals. As a consequence, foreign investment in high-tech services in China from January to June 2016 nearly doubled over the previous year.

As an example of China’s massive investment in infrastructure, in September 2016, a ceremony was held in Zhuhai to celebrate completion of the 55-km cross-sea route between Hong Kong and Zhuhai on the Chinese mainland. More than 400,000 tons of steel are used for the 6.7 km immersed tube tunnel and 29.6 km bridge, which links artificial islands. Construction began in December 2009 at Zhuhai. The bridge starts from Lantau Island in Hong Kong with branches to Zhuhai and Macau. Only road surfacing and related work remains to be completed. Before the project, the 36.48 km bridge across the mouth of the Jiaozhou Bay in eastern Shandong Province was considered to be the world’s longest cross-sea bridge.